Commissioners OK new tax: Schools will carry costs of resource officers

Published 3:36 am Tuesday, October 3, 2017

Members of the Covington County Commission on Monday unanimously approved a half-cent, county-wide sales tax for education in a six-and-half-minute meeting.

The vote was expected to happen last Tuesday, but the motion was tabled because some commissioners wanted to make more formal an informal agreement that the county school system would take on more of the costs associated with having resource officers from the Covington County Sheriff’s Department in the county schools. In the past, the school board and commission have split the costs associated with having deputies work as school resource officers in each school in the county system.

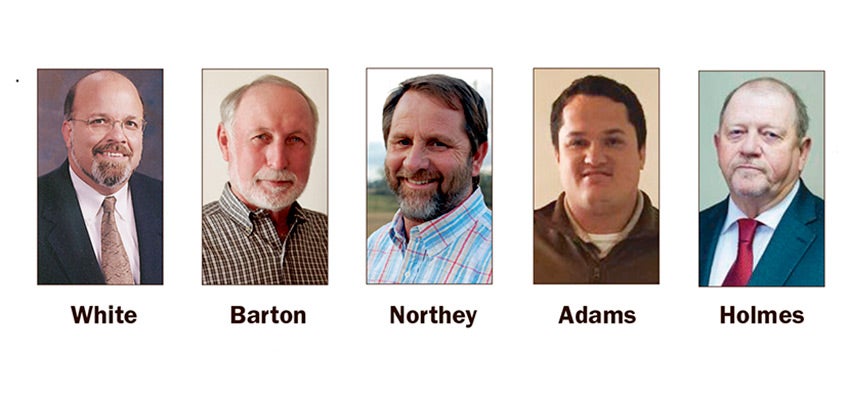

Four of the five commissioners had indicated early in September, while attending a Covington County Board of Education meeting, they would support the tax. But last week, Commissioner Joe Barton – who did not attend the previous BOE meeting – led a move to table the issue.

On Monday, he told fellow commissioners he was comfortable with the plan.

“I talked with each one of board members, and explained our situation to them, what we were doing for them, and they were fine with what we were asking them to do,” Barton said. “They act like they’re ore willing to work with us, and I appreciate them doing that.”

What Barton and others asked, was that they school system absorb the approximately $100,000 in costs the county previously paid of the deputies, covering with the additional tax funds.

Early estimates were that the half-cent, county-wide tax would generate $2.1 million for schools. Alabama law requires that the monies be split according to school population, which means at present, 51.5 percent would go to the county; 31.55 percent to Andalusia; and 26.8 percent to Opp.

Commissioner Tony Holmes said he also had spoken with school board members, who agreed.

“Did they mention putting together some kind of written agreement,” Barton asked.

Chairman Greg White said the board of education is considering adopting a memorandum.

Commissioner Kenneth Northey said, “I’ve not had nobody to disagree with (the tax). I’ve been approached by some with the conditions of some of schools. They’re in good shape, but there are some older things in the school that should have been replaced, but are still working.”

All merchants in the county will begin collecting the tax on Jan. 1, 2018. The tax monies will be remitted to the county for distribution in February.

The measure adds a half-cent sales tax to consumer purchases, and a quarter-cent tax to automobile and farm equipment purchases.